Updated 20240931

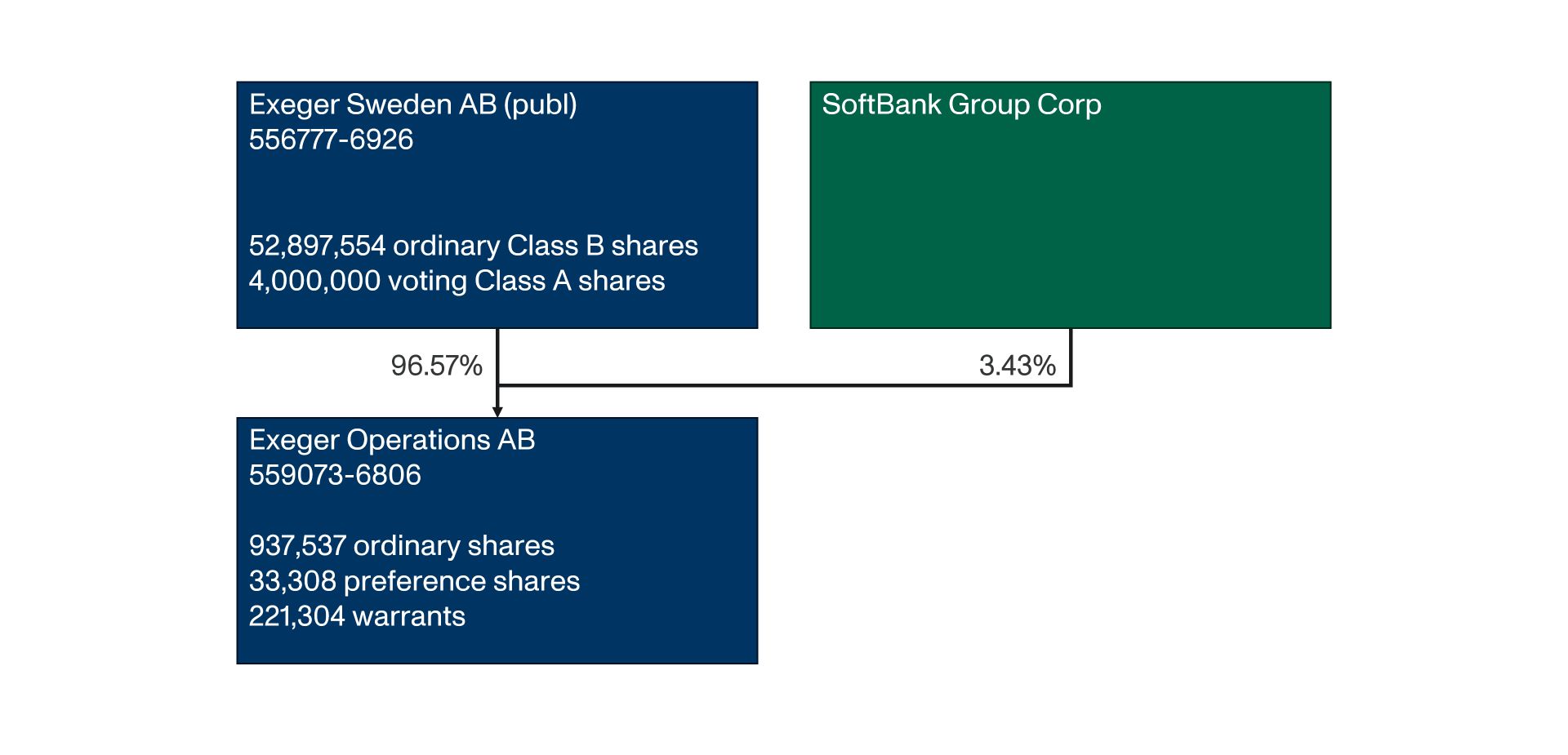

Group structure

Exeger Sweden AB (publ)

Exeger Sweden AB (publ), corporate organization number 556777-6926 is the parent company of the Exeger group. Exeger Sweden has no other assets that its ownership in the subsidiary Exeger Operations AB. The shares in Exeger Sweden are freely tradable and brokered by Pareto Securities and other trading institutes.

Exeger Sweden has:

– 4,000,000 Class A shares outstanding with ISIN SE0018690026;

– and 52,897,554 Class B shares outstanding with ISIN SE0018689994.

The Class A shares have been issued to the founder Giovanni Fili. These shares do not have any economic rights but entitle to a higher number of votes per share. Right now, the Class A shares represent 28,000,000 votes in total (seven votes per share and 34.6 percent of the total votes).

The Class B shares are ordinary shares with one vote per share and full economic rights.

Exeger Operations AB

Exeger Operations AB, corporate registration number 559073-6806, is the operating company of the group, containing all the assets, employees and operations.

Exeger Operations is owned by Exeger Sweden (937,537 ordinary shares or 96.57%) and SoftBank Group Corp (33,308 preference shares or 3.43%). The preference shares give SoftBank Group Corp a 1x liquidation preference on its investment in case Exeger Operations is liquidated. Otherwise, the preference shares and the ordinary shares have the same rights.

The ISIN for the ordinary shares is SE0012506905 and ISIN for the preference shares is SE0012506921.

SHARE REGISTERS

The shares of both Exeger Sweden and Exeger Operations are registered in the record day register maintained by Euroclear AB. The share registers are updated quarterly and copies of Exeger Sweden’s share register can be ordered from Euroclear.

Warrant programs

Exeger Sweden AB (publ)

There are no outstanding warrants in Exeger Sweden AB (publ).

Exeger Operations

There are five warrant programs for employees in Exeger Operations

– TO1 – Series 2018/24:1 (ISIN SE0018741837) with 77,777 outstanding warrants. The warrants have a strike price of SEK 6,206.39 (corresponding to a share price in Exeger Sweden of approximately SEK 110).

– TO2 – Series 2021/24:1 (ISIN SE0018741845) with 10,264 outstanding warrants. The warrants have a strike price of SEK 6,347.45 (corresponding to a share price in Exeger Sweden of approximately SEK 112,5).

– TO3 – Series 2021/24:2 (ISIN SE0018741852) with 10,264 outstanding warrants. The warrants have a strike price of SEK 6,982.19 (corresponding to a share price in Exeger Sweden of approximately SEK 123,75).

– TO4 – Series 2021/24:3 (ISIN SE0018741860) with 10,264 outstanding warrants. The warrants have a strike price of SEK 7,616.94 (corresponding to a share price in Exeger Sweden of approximately SEK 135).

– TO5 – Series 2023/27:1 (ISIN SE0021149184) with 102,464 outstanding warrants. The warrants have a strike price of SEK 13,259.11 (corresponding to a share price in Exeger Sweden of approximately SEK 235).

The first 4 warrant programs (TO1-TO4) mature in October 2025 and TO5 mature in March 2027. The terms of the warrants provide for “cashless” exercise, meaning that each warrant holder upon exercise will not pay the strike price in cash but rather forfeit a number of shares, the market value of which (share price at the time minus the strike price) correspond to the strike price. Upon exercise, no cash will therefore be contributed to Exeger Operations AB but instead the dilution from the warrants will be lower.

The warrants have been, and will be, allocated to Exeger employees in order to offer a long-term incentive.

There are also a total of 10,271 warrants held by lenders (TO6-TO7).